Game of Drones: Archer Aviation (ACHR)

in Our Latest PodCast: Will eVTOL aircraft reboot regional aviation?

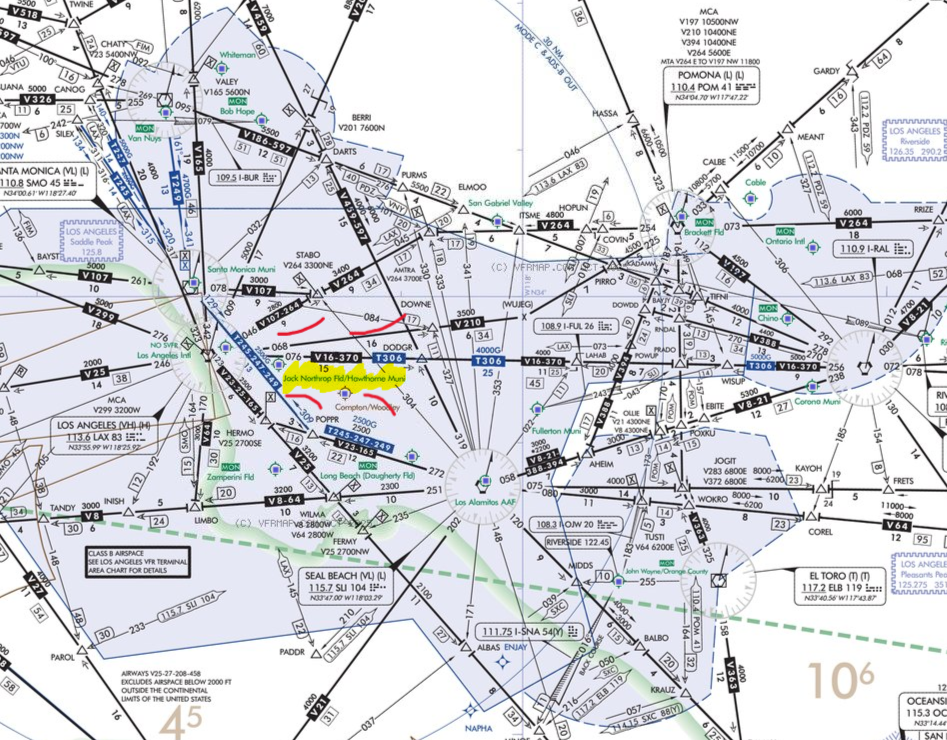

Late last year, next-gen aviation startup Archer Aviation paid a cool $126 million for a master lease on dusty old Jack Northrop Airfield in the heart of the Los Angeles basin.

What seems to matter: The purchase feels like billionaires overpaying for the next bright shiny toy they want to use: Archer is the “Official Air Taxi Provider” for the coming LA28 Olympic Games. Make no mistake, its Midnight eVTOL (Electric Vertical Take-Off and Landing) will be the joyride “status symbol” for the event.

Archer’s achingly glitzy Midnight eVTOL proves no VIP will be caught dead hovering over The Olympics in a mere helicopter. I mean, please.

What actually matters: Underneath the billionaire gloss, Archer is actually making a staggeringly coherent valuation argument for an entirely new kind of regional transportation. Using newly designed electric-powered vertical take-off and landing aircraft that operates in well-defined and regulator-approved air corridors.

Archer now has unlimited access to a pivotal air routes, that connect LA International to all nearby landing areas, including Palm Springs and Malibu.

eVTOLs will probably harvest roughly 50% to 75% gains in operating efficiencies over traditional helicopters.

There are easily dozens of other well positioned airfields, like Northrup Field, that can offer similar eVTOL service, in markets across the U.S. and the world.

In one stroke, Archer controls a central position in the lucrative LA Basin. It can offer service at about half the cost of traditional helicopters.

The Netflix of Aviation? Archer’s is cutting out terribly costly municipal airports. That gives it even more margin to pass on to consumers. But Archer is still aviation – the great invention for burning money.

Archer, and other nascent eVTOL players, Joby Aviation (JOBY), Wisk Aero(BA) and Future Flight Global (EVEX), easily took about $1 billion in expenses in 2025.

Critical regulator “Air Worthiness Criteria” for such “powered-lift” aircraft is still being debated. Congress is also investigating the dubious safety history of similar vertical take-off craft, like the V-22 Osprey.

The ground infrastructure may be the better point of entry: Private capital is already flowing in upgrading private airfields for eVTOL service. Non-aviation revenues are the fastest growing in the sector. And an airfield will always be a tangible asset, at the end of the day.

Some $70 million in annual eVTOL revenue, pictured above, over Los Angeles.

Created by Google Gemini Nano Banana from the prompt: “Passenger eVTOLS providing passenger service over Los Angeles, during the coming 2028 Olympics.”

The Bottom Line: There are about 14 eVTOLs rendered in the above, with about 4 passengers in each plane.

Figure each traveler pays about the cost of a long Uber, or $175.

It’s a 12-minute flight from LAX to Malibu, so 3 trips an hour.

Assume a 14-hour service day, and about 200 service days a year.

That very quickly grosses up to $350G’s per day and something like $70M per year…for just one operator.

It’s been so long since we’ve seen value like this, that we have forgotten what it feels like. And yes, for the first time ever – full disclosure – we actually bought the stock.

After all these years, that is a first.